The global adoption of eSIM technology has been a disruptive force for Mobile Network Operators (MNOs), forcing them to fundamentally rethink their customer acquisition strategies, operational processes, and competitive positioning in a rapidly changing telecommunications landscape. A market analysis from the operator's perspective of the Esim Market reveals a journey from initial apprehension to strategic embrace. A key point related to the Esim Market is that the physical SIM card has long been a powerful tool for customer retention, creating a "lock-in" effect due to the friction involved in switching providers. The seamless, over-the-air carrier switching enabled by eSIM was initially seen as a major threat to this control, potentially leading to higher customer churn. However, the key players in the telecom industry—the major MNOs like Vodafone in Europe, AT&T in North America, and Singtel in APAC—have now largely adopted a more proactive strategy, recognizing the significant operational benefits and new market opportunities that eSIMs unlock. The aggressive push from powerful device OEMs has also made supporting eSIM a matter of competitive necessity.

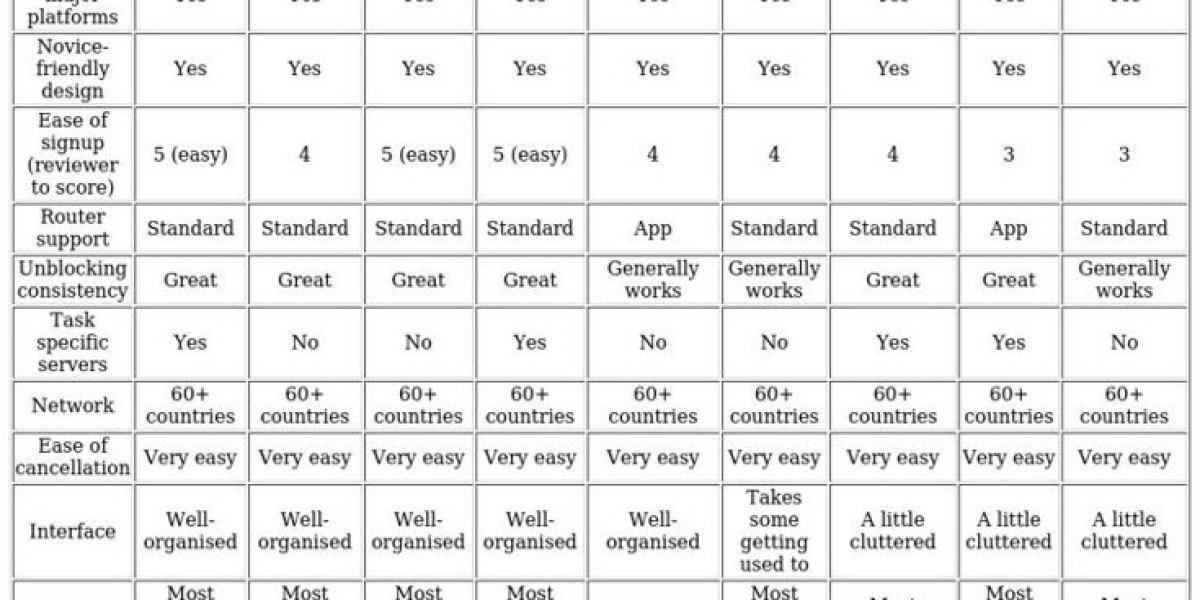

The primary operational benefit for MNOs, and a key point driving their adoption, is the significant reduction in costs associated with the entire lifecycle of physical SIM cards. The supply chain for producing, distributing, and managing inventory for plastic SIM cards is eliminated in a fully digital eSIM ecosystem. This leads to direct cost savings and enables a much more streamlined and efficient customer onboarding process. Key players can now acquire customers through a fully digital journey, where a new user can sign up for a plan online and activate their service instantly by scanning a QR code. This digital-first experience aligns with modern consumer expectations and can be a powerful competitive differentiator. The future in the Esim Market for operators involves leveraging this digital channel to reduce retail overheads and improve customer satisfaction. The Esim Market size is projected to grow USD 29.59 Billion by 2035, exhibiting a CAGR of 31.4% during the forecast period 2025-2035. This growth is partly fueled by the operational efficiencies that MNOs gain, which can be reinvested into network quality and service innovation, a trend that is also taking hold in the competitive mobile markets of South America and the MEA.

Beyond the consumer market, eSIM technology opens up a massive new revenue opportunity for MNOs in the burgeoning Internet of Things (IoT) and machine-to-machine (M2M) sectors, a key point for their future growth strategy. Providing connectivity for potentially billions of IoT devices represents a significant new growth vector for key players facing saturation in their traditional mobile markets. eSIMs are the essential technology for unlocking this market at scale. The future in the Esim Market for MNOs is a shift from selling individual plans to offering comprehensive, platform-based global connectivity management services to enterprises. MNOs in North America, Europe, and APAC are investing in robust Remote SIM Provisioning (RSP) platforms that allow enterprise customers to manage the connectivity of their entire global fleet of IoT devices from a single dashboard. This allows them to compete for large, multinational contracts for connected cars, smart meters, and other IoT solutions, often in partnership with other operators around the world to provide a seamless global footprint. This strategic pivot to the high-growth enterprise IoT market is now a central part of the future strategy for nearly every major MNO globally.

In summary, the key points regarding MNOs and the eSIM market highlight a strategic evolution from a defensive posture to an offensive one. The key players, the MNOs themselves, are embracing eSIM to reduce operational costs, improve the consumer experience, and, most importantly, to unlock the massive revenue potential of the global IoT market. The future in the Esim Market for operators is a transition from being a simple connectivity provider to a sophisticated managed connectivity service provider for a world of billions of connected devices. This strategic shift is a global one, with operators in North America, Europe, APAC, and increasingly in South America and the MEA, all recognizing that mastering eSIM technology is critical for their long-term growth and relevance in the digital economy.

Top Trending Reports -